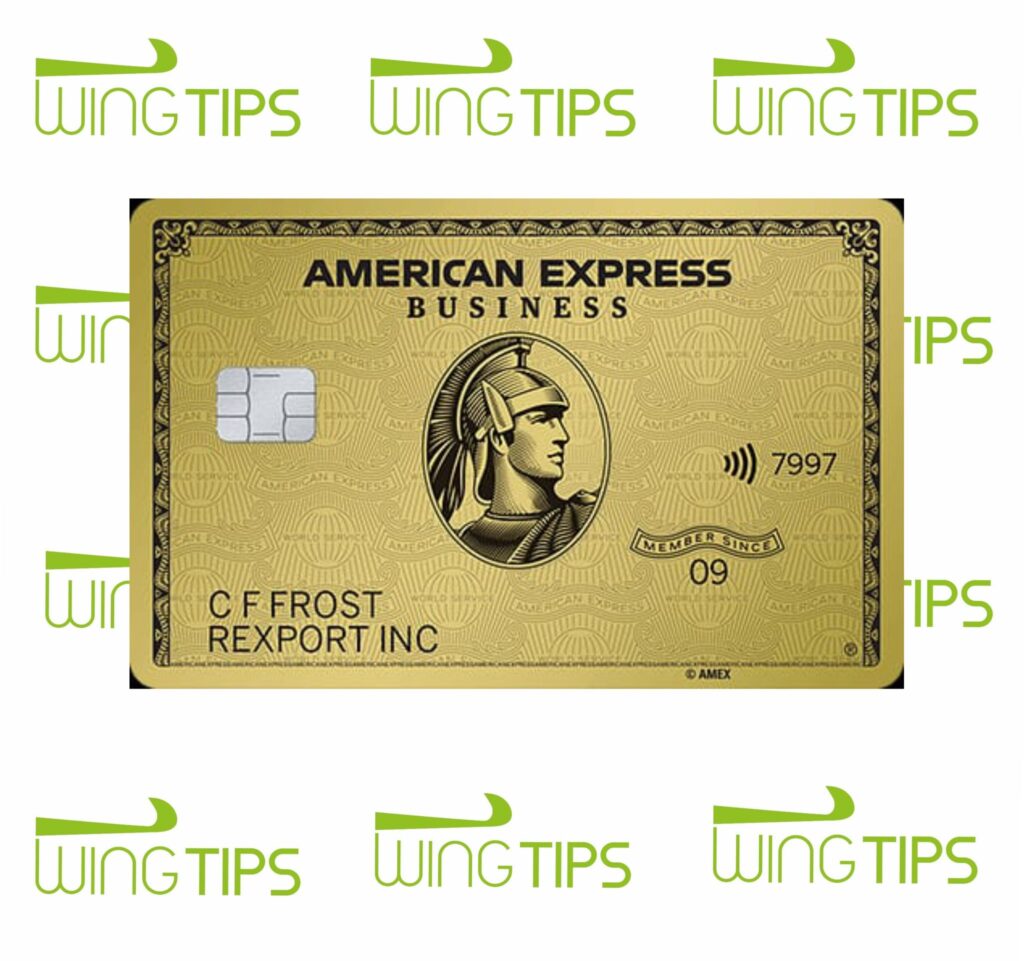

Alright, business builders, let’s talk about the American Express Business Gold Card – a wise choice for sole traders, entrepreneurs, and growing companies who want rewards without a heavy upfront fee. No fee in year one, big bonuses for big spenders, and a seriously flexible rewards program. Let’s get into it. Want more travel hacks and credit card perks? For our entire collection of reviews and guides, click here. Trust me, your wallet’s about to level up.

In This Post

Earning Points: The Lowdown

- Points Accumulation:

- 1 Membership Rewards point per £1 spent on everyday purchases

- Transfer Rate: 1:1 to Avios, Virgin Points, and other major airline programs

- Bonus Points for High Spenders: Spend £20,000 in a calendar quarter and earn an extra 10,000 Membership Rewards points

- What’s a Membership Rewards Point Worth? Typically 0.75p–1p when used for flights; hotel transfers and gift cards also offer good value

- Points Ownership: Membership Rewards points belong to you personally, not your business

Essential Card Details

- Annual Fee: £0 in year one, then £195 from year two (pro-rata refund available if cancelled)

- Representative APR: N/A (charge card, balance must be cleared monthly)

- Minimum Personal Income: £20,000+

- Eligibility: Must be over 18, have a UK home address, a UK business bank account (if not a sole trader), and no CCJs

- No turnover or profitability requirements

Note: The Business Gold is a charge card, not a credit card. Your balance must be paid in full each month. Depending on your cycle, you could get up to 54 days interest-free.

Is the Annual Fee Justifiable?

- Year 1: 20,000 Membership Rewards points for hitting £3,000 spend + no annual fee = very low-risk trial.

- Ongoing: The £195 fee is easy to justify if you earn bonus points and use the Dell credits.

- Pro Tip: Cancel anytime for a pro-rata fee refund after year one if it stops working for you.

The Business Gold Welcome: Sign-Up Bonus

Spend £3,000 within three months, and you’ll earn 20,000 Membership Rewards points.

- Equivalent to 20,000 Avios or Virgin Points

- Also convertible to hotel points with Hilton, Marriott, and Radisson

- Or redeem for High Street vouchers, Amazon, and more

Who Gets the Bonus?

- Everyone, no previous Amex card restrictions!

- If you’re accepted, you will get the bonus after hitting the spending target.

Ongoing Spend Bonuses

Spend £20,000 in a calendar quarter, and you’ll pocket an extra 10,000 Membership Rewards points.

- Example: Spend £20,000 = 20,000 base points + 10,000 bonus points = 30,000 total points (1.5 points per £1)

Travel with the Business Gold Card: Yay or Nay?

Bonus Travel Perk: Book through Amex Travel’s Hotel Collection and enjoy a $100 property credit and room upgrades for 2+ nights at selected hotels.

- Yay: High spending bonuses, flexible reward redemptions, solid extras for small businesses

- Nay: 2.99% foreign transaction fee abroad

Dodge Amex’s 3% foreign fee with Currensea instead – it links to your bank account and only charges 0.5%. Check it out here.

You might also want to pair your Amex with a backup Visa or Mastercard for broader acceptance. I recommend the Capital on Tap Pro Visa – no annual fee, 1 Avios per £1 spent, and no FX fees abroad. Review: Capital on Tap Pro Visa Business Card.

Perks That Make Business Life Easier

- Amex Offers Access: Enjoy cashback or bonus Membership Rewards points with selected retailers through ongoing Amex Offers.

- £100 Dell Credit Annually: £50 between Jan-Jun + £50 between Jul-Dec

- 20 Complimentary Supplementary Cards: For employees, all points earned roll into your personal Membership Rewards account. You can also set individual spending limits on supplementary cards to better manage team spending.

- Consolidated Statements: See all employee spending on one statement

- Travel Detail: Amex statements offer better transaction details for flights and hotels compared to Visa or Mastercard

Tax Tip

The £195 annual fee should be tax-deductible as a business expense, making it even easier to justify keeping the card beyond year one.

Final Verdict: Is Amex Business Gold Worth It?

If you’re a sole trader, entrepreneur, or growing business, the American Express Business Gold Card delivers solid value. With no fee in the first year, a generous 20,000-point welcome bonus, and quarterly bonus opportunities, it’s a clever way to rack up rewards on your everyday business expenses.

Big plans for your business? This card could be the perfect wingman.

Ready to grow your points and your profits? Apply for Amex Business Gold here.

Still Taxiing? Read On:

- Review: American Express Business Platinum Card (UK 2025 Update)

- Review: The American Express Platinum Credit Card (UK).

- Review: American Express Preferred Rewards Gold Credit Card (UK 2025 Update)