Traveling around but want to stay connected? Try Saily!

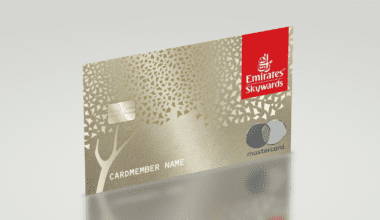

In this article, I will comprehensively review the Emirates Skywards Infinite Credit Card. By the end of this post, you should be able to make an informed decision if you want to obtain this card. To find more reviews on credit cards available in the UAE, including the top travel cards for Emirates business and first class, please click on the credit cards menu at the top of this page.

In This Post

Sign up.

Sign up link to this card can be found here:

Annual fee.

The Emirates skywards infinite card comes with an annual fee of AED 1,575 from the 2nd year onwards, a joining fee of AED 2,999 and a minimum salary requirement of AED 30,000.

Sign-up.

You can earn up to 100,000 Emirates Skywards miles by signing up for this credit card.

How to earn the full 100k sign-up bonus.

The signup bonus for 100k Skywards points is impressive, but it is divided into multiple stages, and it may be challenging for some to spend the required money. Let’s examine the details.

- 35,000 Skywards Miles on payment of the joining fee.

- 40,000 Skywards Miles on spending a minimum of USD 25,000 within the first three billing statements.

- 25,000 Skywards Miles on spending a minimum of USD 7,500 on emirates.com or at any Emirates sales office in the UAE within the first twelve billing statements.

Who can qualify for this card?

You must meet specific requirements to obtain this card in the UAE, as with most cards in the region.

- You’ll need your original Emirates ID and a copy of your passport.

- Latest salary certificate for salaried individuals.

- Trade license for non-individuals.

- Latest 3-month original bank statements (or mini ATM statements).

- Security cheque.

Key benefits.

You will receive a complimentary Rotana rewards membership for one year. An upgrade to Emirates Skywards silver membership. Plus, access to business class lounges.

Rotana rewards exclusive club membership.

The Emirates Skywards infinite credit card gets complimentary Rotana rewards exclusive club membership worth AED 1050. The membership offers the following.

- Rotana dining certificate worth AED 250.

- Up to 50% discount on food bill.

- Up to 20% discount on beverages and room rates.

However, one thing to remember is that the complimentary Rotana rewards exclusive club membership only applies for the first year.

Other benefits.

- Enjoy unlimited free access to over 1000 airport lounges worldwide through LoungeKey.

- Free entry to the best golf courses in the UAE.

- Concierge service to take care of your time-consuming errands

- Valet parking at selected locations in Abu Dhabi

More benefits.

Like other cards in the UAE, this card has numerous benefits, making it an excellent addition to your wallet.

- Valet parking, you are entitled to four complimentary hours of valet parking per month at selected locations in Abu Dhabi.

- Concierge service, you are entitled to up to four annual drop-offs within the UAE. Additionally, a local courier service can be utilized up to 12 times annually for destinations within the UAE.

- Emirates discounts, 3 % discount on air travel and 7% off on holiday packages when you book with your Emirates NBD credit card.

- Free roadside assistance 24/7,

Plenty of amazing discounts and offers are available for you to enjoy in the UAE or around the world. You can take advantage of discounts on car rentals through Avis, airport restaurant discounts, and even medical assistance.

Earning rate.

- You’ll earn 1 skywards mile per 1 USD spent on the card.

- 2 miles when booking with Emirates, FlyDubai, duty-free, online food delivery and car booking apps.

- 1.5 miles on international spend.

- 1 mile on domestic spend.

By enrolling in the Skywards express miles program for a monthly fee of AED 250 + 5% VAT, you can earn 50% more Skywards miles on all purchases, except with Emirates. This monthly fee will replace the annual fee on your card.

Supplementary card holders.

In order to obtain a supplementary card, the individual would require the following information.

- Emirates ID or passport of the supplementary card applicant.

- Original credit card of the primary cardholder.

Conclusion.

The Skywards Infinite credit card is definitely a great card to have, from all the fantastic benefits that come with it to the big signup bonus,

This card offers an earning rate of 1 skyward mile for every dollar spent, making it an excellent option for everyday use. When all the advantages are considered, they sufficiently compensate for the yearly charge of this card.